I remembered watching a TED video about James Randi about homeopathy. On stage, he swallowed a whole bottle of sleeping pills. However, the pills are much more diluted than the actual medicine, and even ingesting the whole bottle of pills does not have any fatal consequences.

You can watch that TED video here: https://youtu.be/c0Z7KeNCi7g

The company’s shares can have the same effect. If the

company keeps issuing new shares, this will dilute the net profit that each

share provides.

As such, I will prefer to the company does the opposite;

reduce the number of outstanding shares. Thus each share will get a large net

profit in the future. This is usually called share repurchase or share buyback.

Benefits

Like eating medicine or supplement, we are expecting some

form of benefits for our health. There are benefits to share repurchase for the

shareholders.

Can only be done by using Cash

A company that generates a lot of cash can do a lot of

things to improve its business or it can return value to its shareholders.

A dividend is the most direct and tangible way to provide

value to the shareholders.

Share repurchase is another way to return value to their

shareholders too, but it isn’t so directly.

Regardless, to buy back their shares from the open market,

they have to use cash.

In this case, how they get their cash is important. I will

look out at their operating cash flow and their free cash flow. If the company

has a lot of operating cash flow and free cash flow, this means the company’s

core operations are generating cash for the company.

There are other ways to generate cash, for example,

borrowings or raising more capital by issuing more shares. These methods of

generating cash aren’t sustainable in the long run.

Improving the Metric

This is kind of technical. Let’s imagine a company has the

following:

·

1000 shares outstanding

·

Net profit $1000 for the year 2000

As such the Earnings per share (EPS) for the year 2000 is $1

(Net profit $1000 / 1000 share outstanding)

Then in 2001, this happened:

·

900 shares outstanding

o

The company brought back 100 shares with cash

·

Net profit $1000 still for the year 2001

Then in 2001, their EPS will become $1.11 (Net profit $1000

/ 900 shares outstanding)

Despite the net profit does not increase from the year 2000

to 2001. However, the EPS has improved simply because the company brought its

shares back.

This affects Return on Equity (ROE) and Return on Asset

(ROA) metric too.

Investors use these metrics, EPS, ROE, and ROA to evaluate

the company.

Compounding Effect

The previous section demonstrates how buying shares improved

the metrics like EPS.

Let’s see what will happen if the company keeps doing that

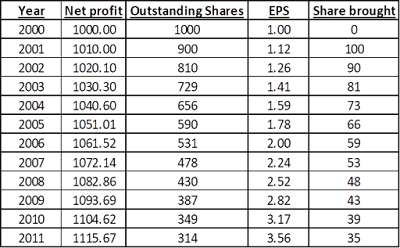

over a few years. The table below shows that if the company keeps buying at 10%

of the outstanding shares.

Assuming that the net profit does not increase over the

years, just decreasing the outstanding shares improved the EPS over the years.

If the company can prosper and increase its net profit, the

effect of compounding is more potent. The below shows that if the company

manages to increase its net profit yearly just by 1%.

This shows that as long as the shareholder keep holding on

to their shares, the shares will be more valuable in the future.

Scarcity

As the company buys back its shares, there is a lesser

amount of shares in the open market.

This means that whoever keeps holding on to the shares will

have a larger percentage of ownership of the company.

Usually, if there are lesser sellers in the market, the

buyers will have to buy at a higher price for the share. As the demand is

higher than the supply, the price of the share may rise.

Shareholders don’t have to pay a cent!

The company will buy back its shares with the company’s

cash. The shareholders are not required to pay for this action.

That being said, that doesn’t mean this action is free, just

that the company is paying for it, reducing their cash for shares.

Tax?

As the company buyback their share, it isn’t a payment to

the shareholders, unlike a dividend. As a Singaporean Investor in USA-listed

companies, the dividend is taxable. At the time of writing (17/6/2022), there

is a 30% withholding tax on my USA company's dividends.

Which isn’t an income to the shareholder; as such there

isn’t a tax on it.

Drawbacks

Although supplements are good for health, overconsuming

certain vitamins may have negative health outcomes.

Similarly, companies can benefit from buying back their

shares. But it isn’t an action that can be used every time and in every

situation. There are drawbacks if the company applied share repurchase

inefficiently.

Can only be done by using Cash

If the company is unable to generate excess cash, it may not

consider this action. Improving their business operation should be their focus.

If the company uses loans to buy back its shares, I probably

have to listen carefully to its rationale. This course of action is usually

considered unwise. If I am not satisfied with the reason, I will skip this

company.

Not at any Price

The company will benefit more if it buys the share at an undervalued

price.

However when comes to intrinsic value, it can be subjective.

As everyone values the same investment differently.

As such, if the company management is ridiculously

optimistic about their company share, they may just buy the shares recklessly.

This may reduce the efficiency of their money.

For example:

A company has allocated $ 1 million to buy back its shares.

That company’s Book Value per share is $100 per share. For

simplicity’s sake, let’s take that as the company’s intrinsic value.

It also has 10 million outstanding shares.

Assuming the company’s net profit is $10 million.

As such, depends on the Price to Book (PB) value the company

brought the shares:

As such, the table shows that as best as possible, if the

company can buy their shares as cheap as possible, they can buy more shares

back. The effects of their share buyback will be more effective on the EPS.

As such, it isn’t a good idea to just buy the shares at any

price. Buying it cheap against the intrinsic value is more efficient.

However, there is more than 1 way to valuate a company. If

the management wants to buy the shares back, they can easily justify with a very

optimistic valuation and then buy back the shares.

Summary

The share buyback is a good sign for the company in general.

The company must have the cash to buy back shares. If the company is generating

a lot of cash from its operations, this can compound to those shareholders who

still holding on to their shares.

What price does the company buy is the issue. However, even

if the company pays a high price for its shares, it is still in favor of the

shareholders. Just that it isn’t that efficient.

As best as possible, the company should buy its shares back

as cheaply as possible. Of course, life isn’t as smooth as we wish to be. We

can only prepare for the good and bad things to come.

No comments:

Post a Comment