I am taking a peek at Utilities Companies in USA and Singapore.

Why so? It isn’t going to grow or prosper like those sexy

tech companies. Nor does it have the hype either. Unless Elon Musk tweets about those companies out of the blue.

But in theory, at least some people believe that the Utility

sector has some advantages:

·

A defensive sector

·

Produce goods and services with inelastic demand

However, because of the Utilities’ characteristics, they do

have some problems:

·

Very heavily regulated

·

Very Capital intensive

Defensive Sector

In theory, the Utility sector underperformed when the market

rallies. However, when the market falls, the Utility sector remains relatively

resilient.

From Gurufocus, this is the overall performance for the past

10 years. VOO is the ETF for S&P500, while VPU is the ETF for the Utility

sector.

How do I know if this theory is true or otherwise?

Maybe I just need to look at the recent months. Thanks to

the Fed’s rising interest rates, the overall market share price is dropping.

Well… looks like the Utility sector (VPU) doesn’t fall as much compared to S&P 500’s VOO.

What about a rally?

I am using 1/1/2020 to 1/1/2021, a recent rally and it does

show that while VOO is improving by 51%, VPU was only 18%.

Although I only did a comparison for the recent times, it

does seem Utility is kind of resilient.

Inelastic demand for their products and services

What is Inelastic

demand?

It is when the demand or consumption of a certain product or

service remains relatively the same even when the price has increased.

For example, 30 eggs were priced at $6.50 back in Feb 2022.

However, in April 2022, it has become $7.05. But customers still bought

relatively the same amount of eggs daily. (At least for me though.)

Although in May 2022, some supermarkets' 30 eggs prices had

gone down to $6.75, I still consumed roughly the same amount of eggs monthly.

Thus, my demand for eggs is pretty inelastic.

The Utility sector products and services have similar

characteristics. They provide electricity, gas, and water. Not only are they

difficult to give up, but they are extremely difficult to adjust our

consumption without resulting a big impact on our daily life.

Very Heavily Regulated

Because the Utility’s products and services are inelastic,

in economic terms. This results in 3 important implications.

Not sensitive to income growth or economic activity

Usually, when the public becomes wealthier, they may indulge

more. For example, dine out in the restaurant more often, or buy the latest

luxury watch.

The utility may not able to enjoy a lot of this additional

spending from their customers. Drinking more water probably is the last thing

in their mind when they strike a lottery.

Vice versa, if the public received a pay cut, they may spend

less. Instead of dining out, they may cook at home, which is cheaper. However,

the utility may not suffer a huge reduction in their customer demand. The

customers may consume lesser, but there is a level of consumption needed to

maintain their basic needs.

Thanks to this factor, the Utility sector is relatively

resilient during an economic downturn.

Natural Monopoly

Utilities are a fine example of a natural monopoly.

Natural monopolies can appear when one company is much more efficient

than other competitors in providing the goods or services to the market. Even

without unfair business practices that company will over time become a monopoly

due to the market conditions.

This may happen in two ways:

1.

The company takes advantage of the industry’s

high barrier to entry, thus creating a “moat” around its business operations.

One example is the high cost involved. A water utility needs a lot of machinery,

and a pipe network, to satisfy the water safety requirement set by the

government and hire a large number of specialists, engineers, and technicians.

2.

The company is producing at a scale so large

that it is so much more efficient than small-scale production. And that company

satisfies all the available market demand. Thus, the small-scale producers

can’t compete due to cost.

Utilities tend to be a natural monopoly thanks to the high

cost involved and it doesn’t make sense to have another company compete against

it. Sooner or later, one company will remain either the competitor bankrupt,

give up or merge with a superior company.

Regulations

As Utilities will naturally become a monopoly, they may

abuse their unique position and may raise prices without control. Thus, the government

will have to step in to ensure there is no such abuse. As Utilities are essential,

almost irreplaceable, and vital to the economy, as this gives the government a

very strong reason to regulate them. To ensure the utilities are reliable, cost-effective,

and still affordable enough for everyone.

But are Utility companies good?

Whether a company is good is subjective. However, in my

case, I look for a company that can is it:

·

Profitable?

·

Good cash flow generation?

·

Able to grow?

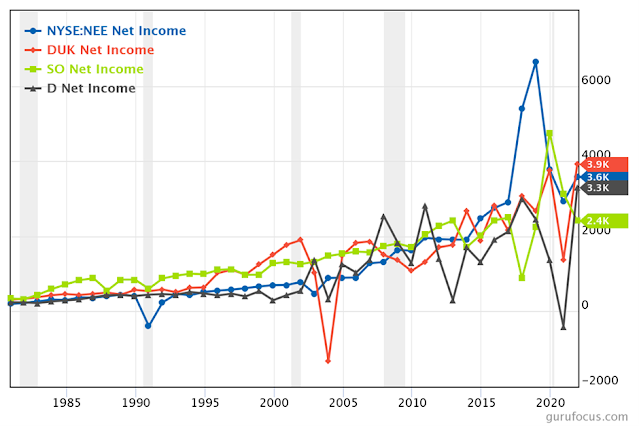

I take references from the utilities in the USA first. And

let’s see if we can find any patterns. Sadly, there are too many utilities

listed in the USA, I just use the top 4 market cap and see if I can learn

anything from it.

In this case, I will be looking at NextEra Energy (NEE),

Duke Energy (DUK), Southern Co (SO), and Dominion Energy (D).

USA Utilities: Profitability?

But their net profit doesn’t grow as much as their revenue.

But profitable MOST of the time.

USA Utilities: Cash Flow?

Looking into their cash flow from operations can give us an

idea of how much cash it generates from their operations.

Most of the time they are generating an increasing flow of cash into the companies.

However, their free cash flow is another story… as Free cash

flow is the reminding cash after cash flow from operations deduct from capital

expenditures, this shows that to remain in business, utilities need to

re-invest themselves. Re-invest itself… Heavily.

USA Utilities: Growing?

This is a bit tricky… what metrics show that the

company is growing?

Maybe let’s look at their cash.

The result is a kind of mix, SO’s cash is growing over time.

D’s cash is maintained at a certain range. But overall, most of their cash has

wide volatility.

Let’s look at other areas, like their property, plant and

equipment. They need these to provide their utility service to the public.

Well… this assets liner is increasing over time. Generally

speaking for all the companies.

Retained Earnings are another way to check whether the

company is growing.

Looks like only NEE has a good growth in its retained

earnings. While the others are still growing, but not as explosive as NEE.

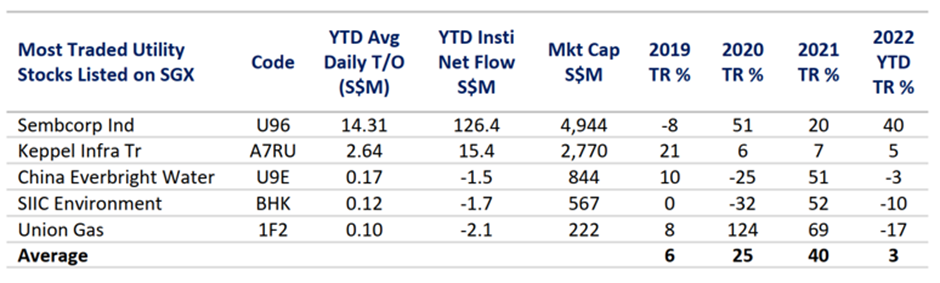

Singapore Utilities

Philip Securities newsletter email has sent me some suggestions,

I will be looking at SembCorp Industries Limited (U96), Keppel Infrastructure

Trust (A7RU), China Everbright Water Ltd (U9E), SIIC Environment Holdings Ltd

(BHK), and lastly Union Gas Holdings Ltd (1F2).

Now in Singapore, let’s see if we can find any insights.

Same as the USA’s Utilities, I will be looking at their profitability, cash

flow and whether can they grow.

I will be showing 1 chart with all 5 Singapore utility

companies, and 1 chart without Sembcorp Ind (U96). The reason is that I would

like to compare all of these companies together, but U96’s data is larger than

the other companies, which distorts the chart for the other 4 utility

companies. So I will show another chart without U96 to have a better view of

the other companies.

Singapore Utilities: Profitability?

Let’s look at their Revenue first.

While Sembcorp (U96) has had huge swings in its revenue over

the years, it is the largest out of the 5.

Apart from Union Gas (1F2) seems to grow its revenue the

slowest. Otherwise, the rest seems to be quite ok. They can grow their revenue.

Although U96 has the biggest revenue, its net profit doesn’t

seem to match its revenue size and suffer a loss in the year 2020. Keppel Infrastructure

Trust (A7RU) has also suffered losses in the recent 2 years too. Otherwise, these companies usually are

profitable.

Singapore Utilities: Cash Flow?

Unable to see a clear pattern, but there are times some

companies will have negative cash flow from their operations.

Their free cash flows show a similar pattern as their

operating cash flow.

Singapore Utilities: Growing?

Again, let’s have a look at the cash

While U96 has the most amount of cash, the rest of the companies (most of them actually) manage to increase their cash in hand.

All of them increased their property, plant and equipment,

but U96 and A7RU increased their property, plant and equipment more than the

rest.

Only BHK’s retained earnings are performing well. A7RU is

getting worse and worse. Weird… A7RU is profitable but its retained earnings aren’t

accumulating.

Observation

Singapore Utilities and USA Utilities are different.

USA Utilities are performing in their operating cash flow, able

to invest in themselves and grow their retained earnings.

Singapore Utilities, although their operating cash flow isn’t

consistent, can increase their cash in hand. They do invest in themselves, but

their retained earnings aren’t that consistent.

Well… recently I learned that, if it isn’t obvious then stay

away.

I guess for Singapore Utilities, I probably stay away. It isn’t

obvious to me that these companies are prospering.

But for the USA Utilities, there are more than what I just

found. Maybe I can spare some time to search for some interesting companies

that might be worthy of deeper research.

Your Humility,

Manferd

No comments:

Post a Comment