Stonks!

Seriously… this year has been stonking for a lot of markets.

At the start, the Japanese market rallied after decades of

bad performance.

Gold rally in early 2024 too.

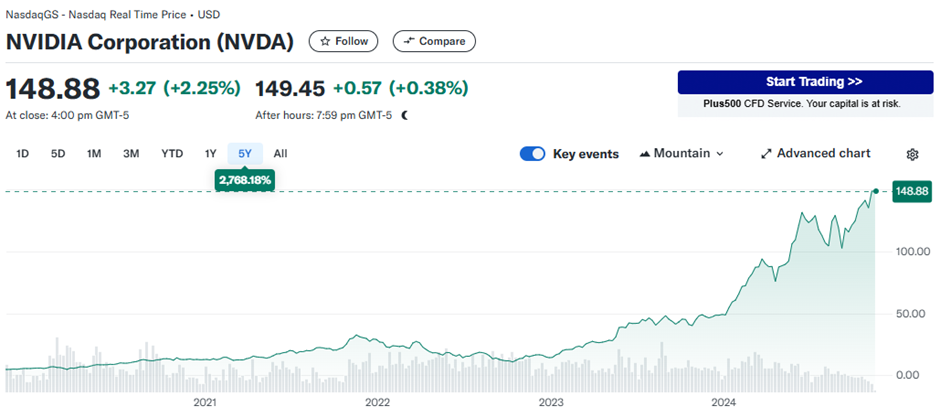

NVIDIA Corporation’s share price has exploded upwards too.

Even when there was a crypto winter last year, NVDA still

caught another tailwind, AI.

At the start of the year, everything is going great!

A rising tide lifts all boats

I never knew this saying was true. While I can’t exactly be

sure what causes the market to stonk, not just in the USA but all around the

world and all kinds of asset classes.

That get me wondering, is it necessary for me to develop

strong investing skills?

All I need is just to position myself in a good ETF

portfolio and ride on it.

I can do stock picking, but I can be wrong, lose, or

underperform with that position sizing.

Or I can be roughly right, dollar cost average (DCA), and

ride the economy of those ETFs I picked.

I think the answer lies in my results…

And I still think it is important to develop strong

investing skills and habits. As there are many financial pitfalls that can hurt

my returns.

One of such pitfalls I believe is using leverage badly…

Which brings me to…

August Yen Carry Trade

I won’t explain what happened in August 2024. But in short,

some people borrow in Yen and buy high-quality assets that are denomination in

other currencies.

However, when the Bank of Japan changed its policy, the

profitability of this strategy diminished, and those investors sold off their

assets and repay their loans.

I believe that whoever is able to come up with this strategy

and execute it should be considered as sophisticated investor.

To be able to calculate that there is a profit to be made

between the currencies and the investment. Also able to have the credit

available in Yen and come up with a plan to minimize the ‘damage’ in the event

any of the factors don’t turn in their favour.

In short, they are smarter and have more resources than

usual retail investors.

While they are superior to me in financial strategy and

resources, I still want to thank them for doing this. As I didn’t waste this

‘crash’.

While I benefited from this event, I also wonder:

·

Does being smarter and having more resources

give investors an edge?

·

Do I have to wait for others to make mistakes so

that I can benefit from it?

Speaking of mistakes…

Were the Signs there for Great Eastern privatization?

During late 2022, in the Dividend Investment telegram group…

members there has taken note of a certain “behaviour” of Great Eastern. The

signs they noticed were:

·

OCBC has been buying more of Great Eastern’s

shares over time. (in terms of years)

·

Great Eastern’s Management has been rewarded

with OCBC shares instead of Great Eastern Shares

·

Great Eastern share price was inching upwards,

indicating someone has been buying

The group believed that there was a ‘conspiracy’. That alone

wasn’t good enough to take action. Some rationalized and stated that Great

Eastern was a good investment and the dividend yield was attractive back then.

Some are convinced and acted by buying some Great Eastern

shares.

While I am convinced that the signs seem to hint that OCBC

was planning to do something. But what was their end-game goal, I wasn’t sure.

And I was also at the crossroads. Hong Kong was really

depressed for 3 years. Hang Seng Index (HIS) was very close to the 2008/2009

level too. I wonder which to research first.

Great Eastern on the rumour that it might be privatization.

OR

Look for HK companies that have a great moat and good

dividend history.

I turned my eyes to HK companies instead and managed to find

3 companies.

Then in May…

Haiya…

I missed out on this deal as I have not done my due

diligence yet.

While looking back, I don’t think I made an investment

mistake by just blindly buying Great Eastern.

I do feel that I am a fool for not looking into Great

Eastern first.

This incident does make me reflect on how I research. How

can I research fast and concisely yet still be able to come to a good

conclusion about the company?

Reducing what I am checking doesn’t help if it does not

address my concerns about a company.

While I have a template to base on, I still have factors

about the company I need to look at to ensure peace of mind.

Especially the economic moat of a company, which can be very

tricky…

Now… I learned a unique way of finding companies with wide

and deep economic moat.

Allow me to introduce you to a free method…

US Department of Justice sued who?

This year, I learned that US Department of Justice (DOJ) has

been… suing…

DOJ has sued Google…

https://edition.cnn.com/2024/08/05/business/google-loses-antitrust-lawsuit-doj/index.html

followed by Visa…

soooo… what does this mean?

DOJ sued companies that they believe have infringed some

kind of laws that aren’t helpful for consumers or stopping other companies from

gaining a foothold in the same industry.

In short… they believe these companies have… a monopoly.

Naturally, the market will react negatively to the news.

However, I think the market may forget about it and carry on

doing their business. These companies are still conducting and doing their

business too. Cash is still flowing into the business.

While I believe that these court cases are good examples of

how to make use of bad news. I still believe that invest should research on

these companies and be aware that in the event these companies lose the court

case, how will the DOJ impact their business.

Otherwise… DOJ has 1 part for us, they helped us identify

companies that have a monopoly in the USA.

To Err is Human

This year, I made mistakes.

This year, others made mistakes too.

While mistakes are made, I hope that I can learn from my own

mistakes and try to become better.

But on the other hand, I am also waiting for others to make

mistakes.

So that I can benefit from theirs.

I just hope that I can benefit more than the mistakes cost

me.